Online shopping and online payment processing are fast becoming the new normal, and it would do your business well to expand your payment processing capabilities to suit the needs and preferences of your customers.

There are so many payment tools for small business when it comes to receiving and processing payments. But some live in countries where the payment platform is not accepted. Others may not be equipped with the features you need to grow your small business. It’s possible that these payment processors don’t exactly fit.

So it’s time to review these payment tools for your small business to use today. This way, you can accept payments for your business more easily and affordability. While there are hundreds of options out there, here are 10 recommendations to get you started.

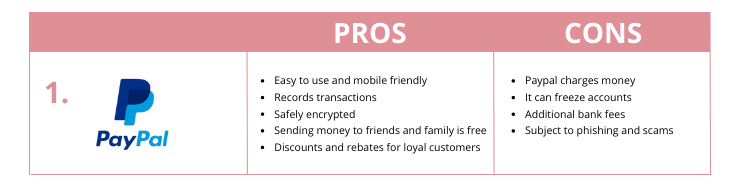

Paypal is a great platform to use if you need to pay for invoices, send money, or receive money. It has become one of the most trusted payment platforms online. This option is best for e-commerce businesses looking for standard payment processing. PayPal offers a fast, simple way to start accepting payments. But you’ll need to check with your shopping cart provider or e-commerce platform to confirm whether PayPal checkout is compatible with your site.

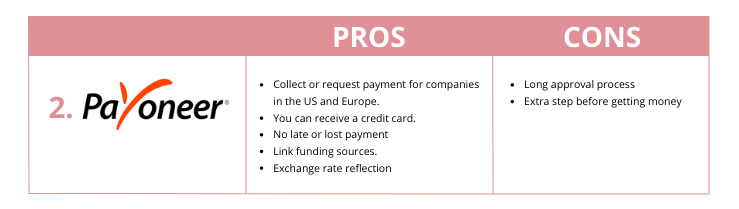

Payoneer is the world’s go-to partner for digital commerce, everywhere. It specializes in the ability for a business to make mass payments to customers all over the world, but it also offers a payment processing solution. It is a popular option for freelancers and international businesses, as well as users of major e-commerce marketplaces like Airbnb and Upwork.

Payoneer allows you to receive and withdraw funds through deposit in your local bank account, use of the Payoneer Prepaid Mastercard or through an online store affiliated with Payoneer’s network.

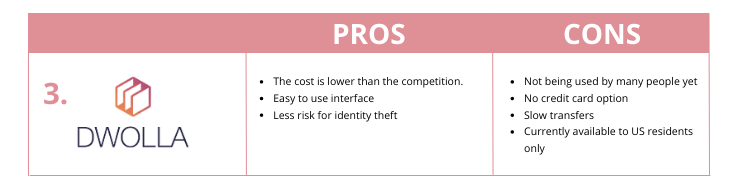

3. Dwolla

Dwolla is a white-label service that allows businesses to receive ACH payments at low fees. It is a developer-friendly payments system that lets you customize how you make and receive recurring, bulk or single payments. Offering a free account with no transaction fees, it only links to a U.S. bank account or credit union account. There are no account setup fees or transaction fees. However, Dwolla is strictly made for domestic payments.

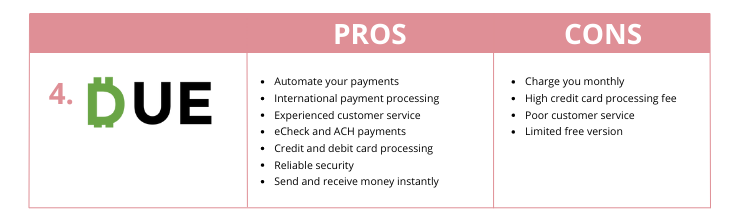

4. Due

Due is a payments solution company that offers credit card processing and international credit card processing. It has integrated PayPal and Stripe for further payment options, and in addition, it offers time-tracking and online invoicing. Due is also an end-to-end payment solution. This means it comes with time tracking, online estimates, and invoicing tools, as well as online database management capabilities.

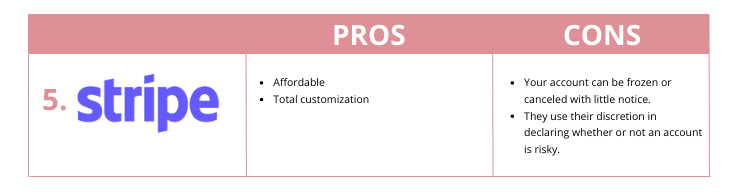

5. Stripe

Stripe Payments is a powerful tool business that want to sell online with its customizable checkout, extensive integrations, and advanced invoicing and recurring billing features. Stripe was built for developers to create custom payment solutions, but it can also be used in its basic form. Even as a standardized payment platform, it is packed with features like integrated mobile payments for iOS and Android, checkout, the ability to add coupons and recurring billing.

As a global payment option, it works with over 100 currencies, as well as Bitcoin and local payment instruments like Alipay. You can also accept digital payment services like Apple Pay, Android Pay and AmEx Express Checkout.

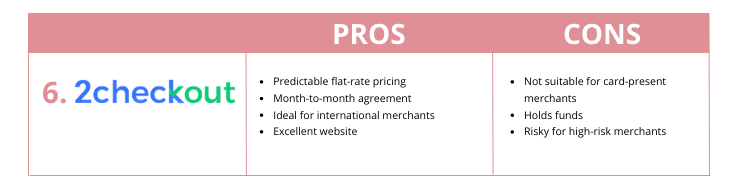

6. 2Checkout

2Checkout focuses on global payment acceptance, providing you with a secure and compliant gateway to do business in nearly every country around the world. It offers both online and mobile payment platforms, as well as features like recurring billing, hosted checkout, fraud protection, and integration with the most popular online shopping carts.

You can accept all major credit and debit cards as well as PayPal, and then get paid by bank or wire transfer. Transaction fees are a flat 2.9 percent plus $0.30 per transaction with no set-up or monthly fees.

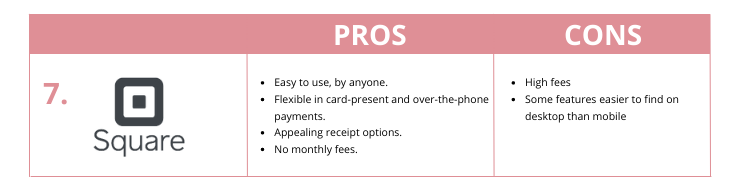

7. Square

Square is a credit card processing company that provides a way for small businesses to accept credit cards without carrying the burden of additional fees. It has become one of the most versatile payment solutions for small businesses. It allows you to accept payments from anywhere thanks to its innovative mobile card reader. This converts your mobile devices into a POS system.

Square also provides fraud protection, deposits on demand, and the Square Stand for larger businesses. With the Square app you can build a customized register, as well issue receipts and invoices, track inventory, view sales reports, and manage timesheets.

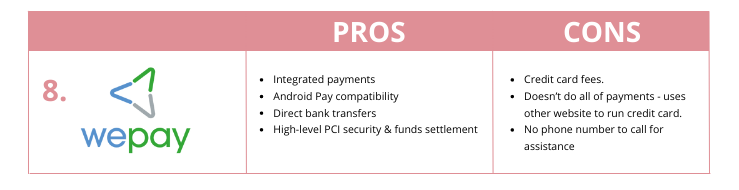

8. WePay

WePay helps online platforms increase revenue through integrated payments processing.With WePay you can customize everything from checkout forms, confirmation emails, customer support emails, credit card statements, and mobile transactions. It also provides on-the-go payment capability with a mobile chip card reader, mobile SDKs, and fulfillment service so that you can embed payments into a single mobile app for a more complete and seamless user experience.

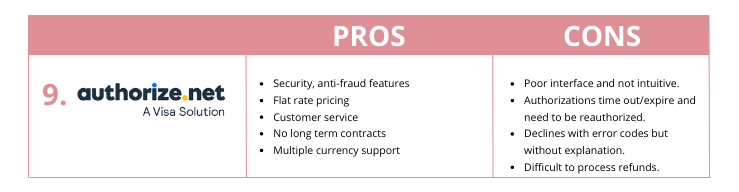

Authorize.Net’s payment gateway is one of the most versatile tools for eCommerce. It’s got a solid feature set, including recurring billing and echeck/ACH processing. Although there are no annual renewal or hidden fees involved, there are some other fees to consider: a $49 set-up fee, $25 per month gateway fee and 2.9 percent plus $0.30 per transaction.

10. Braintree

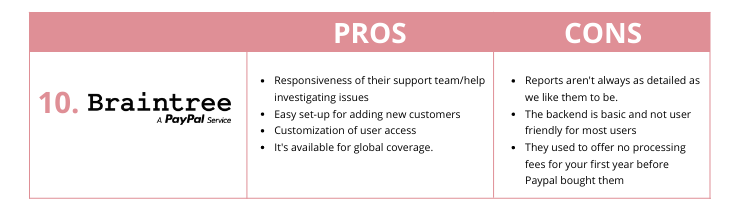

Braintree is a payments company that provides elegant tools for developers and white-glove support. As part of PayPal, this company has bolstered the company’s payments expertise and provided more options for you to pass onto your customers -- like Venmo, Apple Pay, Android Pay, Bitcoin and debit and credit cards. There are no extra fees, including no fees for refunds, inactivity or failed transactions. You only pay for those transactions you actually carry out. After your first $50,000 in transactions, you will pay as little as 2.9 percent plus $0.30 per transaction.

Bottomline

And that's it! How do you know which payment tools will be the right fit for your business? Well, as the person who knows your business best, it will be up to you to know which payment tools will be able to fulfill your needs. However, here are some guidelines on how to proceed through the decision-making process. As you’re looking into different payment tools, ask yourself these questions:

- Who is my typical customer?

- Where does my average transaction take place?

- How will customers want to pay for the goods or services my business offers?

By answering these questions, you’ll be able to narrow down your options and start considering other factors like price, customer service, and additional features. We have no doubt you’ll find the one that’s right for you.

Just before we get into some actionable steps,If you are new to affiliate marketing, tohelp you along, we have created a free "Affiliate Marketing Strategy Cheat Sheet” according to which you can build your "Affiliate Marketing StrategyMap.”

GRAB OUR FREE AFFILIATE MARKETING STRATEGY CHEAT SHEET AND BUILD YOUR AFFILIATE MARKETING STRATEGY MAP

You can choose to comment as a guest.